Palo Alto (PANW) Earnings – AI Impacts

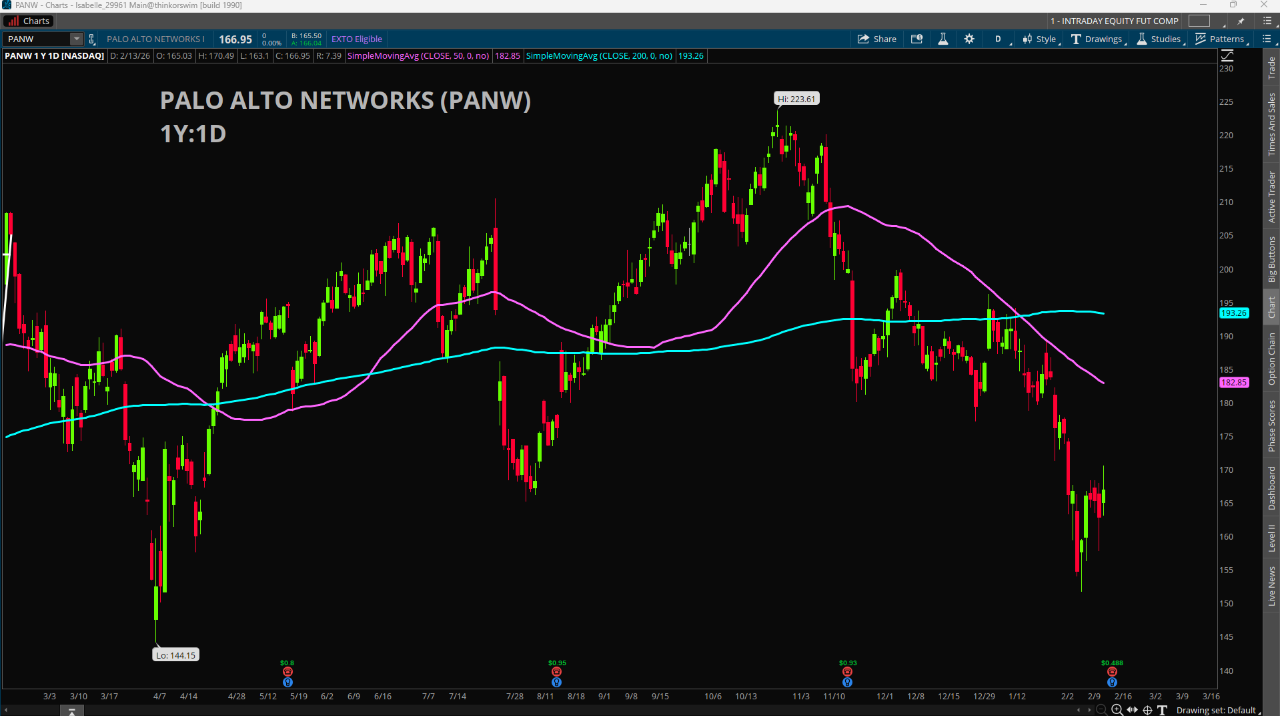

Palo Alto Networks (PANW) reports earnings after the close today and the bar is low going into the report. The stock has fallen 25% off its all-time high of $223.61 from late October. Palo Alto shares are in bear market territory as the market reassesses the threat that generative artificial intelligence (AI) poses to many existing businesses. While software stocks have taken the brunt of the AI sell-off, cybersecurity stocks have been repriced amid fears that AI developers will be able to replicate their capabilities for less.

The cybersecurity company is at a critical juncture, with shareholders looking for validation of its aggressive "platformization" strategy amidst slowing growth and a high-valuation stock. Palo Alto is successfully convincing clients to consolidate their security budgets, replacing multiple vendors with its unified platform. The company reported adding 60 net new platform customers in 1Q 2026, with significant traction in deals over $5 million and $10 million.

As cybersecurity needs grow more complex with on-site data moving to the cloud and workforces operating remotely from around the world, there's an increasing need for more solutions. The recent, aggressive expansion into adjacent markets, specifically the $3.35 billion acquisition of Chronosphere and the addition of CyberArk, indicates a strong push for dominance in AI-era, cloud-native security.

Another concern for investors is the continued deceleration of sales growth, falling from the mid-20s percentage in FY2023 to the low-teen range expected for FY2026. Macroeconomic uncertainties, such as high interest rates and geopolitical risks, are causing enterprises to delay large, multi-year technology investments. But the thorn in the side of Palo Alto and other cybersecurity firms continues to be the impact of AI on their future.

The option market is pricing in a one-day +/- 8% move or about $13.00 in either direction. Valuations are still elevated in the stock despite the recent meltdown over the last quarter. The Forward P/E ratio for Palo Alto Networks (PANW) stock is near 42 times based on next-twelve-months earnings estimates. This forward-looking valuation suggests a lower multiple compared to its trailing P/E, which is above 100x, reflecting projected earnings growth. With the stock having dropped significantly from its October highs, the market needs to see "beat and raise" performance to maintain support of the premium valuation.

Featured Clips

DraftKings (DKNG) CEO on Sports Betting Uptick, Using AI & Prediction Markets

Opening Bell With Nicole Petallides

► Play video