Tech Earnings Buoy Markets While Fed and Trade Uncertainty Simmer

Markets entered a pivotal week beginning Monday, with U.S. equities trading near record highs amid optimism around a newly finalized trade deal between the U.S. and European Union, structured around a lower-than-expected 15% tariff on European imports. Widespread anticipation centered on a dense slate of events including quarterly earnings reports from Apple (AAPL), Amazon (AMZN), Meta (META), and Microsoft (MSFT), critical macroeconomic releases, and Federal Reserve monetary policy decisions.

On Wednesday, the Federal Open Market Committee held the federal funds rate steady at 4.25%–4.50%, consistent with market expectations. Chair Jerome Powell reaffirmed the Fed’s wait and see stance, emphasizing that inflation still appears elevated, especially amid tariff-driven price pressures and a tight labor market. He notably refused to endorse speculation about a September rate cut, undercutting market expectations that had priced in as much as a 70% probability earlier in the week.

Rather than multiple rate cuts in 2025, Fed officials may not cut at all. The futures market odds of a 25-basis-point cut at the Fed's next meeting in September fell to about 40% hours after the Fed's announcement. With just three FOMC meetings before the end of the year and inflation still moving away from the central bank's 2% target, the likelihood of 2025 without a rate cut is increasing.

Inflation dynamics was a key focal point of economic data. The June PCE data showed inflation lingering above target, with tariffs estimated to be adding roughly 0.3%–0.4% to consumer prices. Core PCE price index rose 2.8% year-over-year for June, while the headline index was up 2.6% year-over-year. This was just above the expected 2.5% annual growth and up from 2.4% in May.

While the underlying annual core PCE rate has cooled, it remains elevated enough to justify the Fed’s caution. Combined with signs of moderating GDP growth and resilient jobless claims, the data painted a picture of stubborn inflation and a still-resilient economy, which is unlikely to prompt a near-term policy shift.

Corporate earnings for several heavily weighted tech names delivered further nuance. Meta Platforms and Microsoft both reported strong earnings and reaffirmed growth drivers in AI and cloud investments, lifting their share prices sharply: Meta by about 11%, and Microsoft about 4%.

Amazon and Apple were also in focus, with Amazon benefiting from robust revenue trends in AWS. Apple announced much better than expected results featuring strong top and bottom-lines led by iPhone and Services, particularly in China which returned to positive growth — +4% when compared to the same quarter last year.

Trade policy developments loomed just as large. The U.S. and E.U. deal that cut tariffs to 15% on European goods offered relief, but across-the-board “reciprocal” tariffs remained on the horizon. President Trump had set August 1 as the deadline for further tariffs on Canadian and Mexican goods, and a 50% tariff on copper imports was set to take effect that same day unless exemptions applied. Copper futures collapsed roughly 22% after the tariff announcement earlier this week.

Equity markets remain bifurcated amid the week’s developments. Gains in mega-cap tech supported the Nasdaq and S&P 500, although defensive and industrial stocks have lagged. Narrowing market breadth, rising valuations and weak seasonal average performance in the later part of summer are in focus by bears who are waiting for equity markets to finally take a breath and consolidate. Despite equity indices that remain near record levels, sentiment is increasingly anchored by macro complexity and geopolitical risk.

Featured Clips

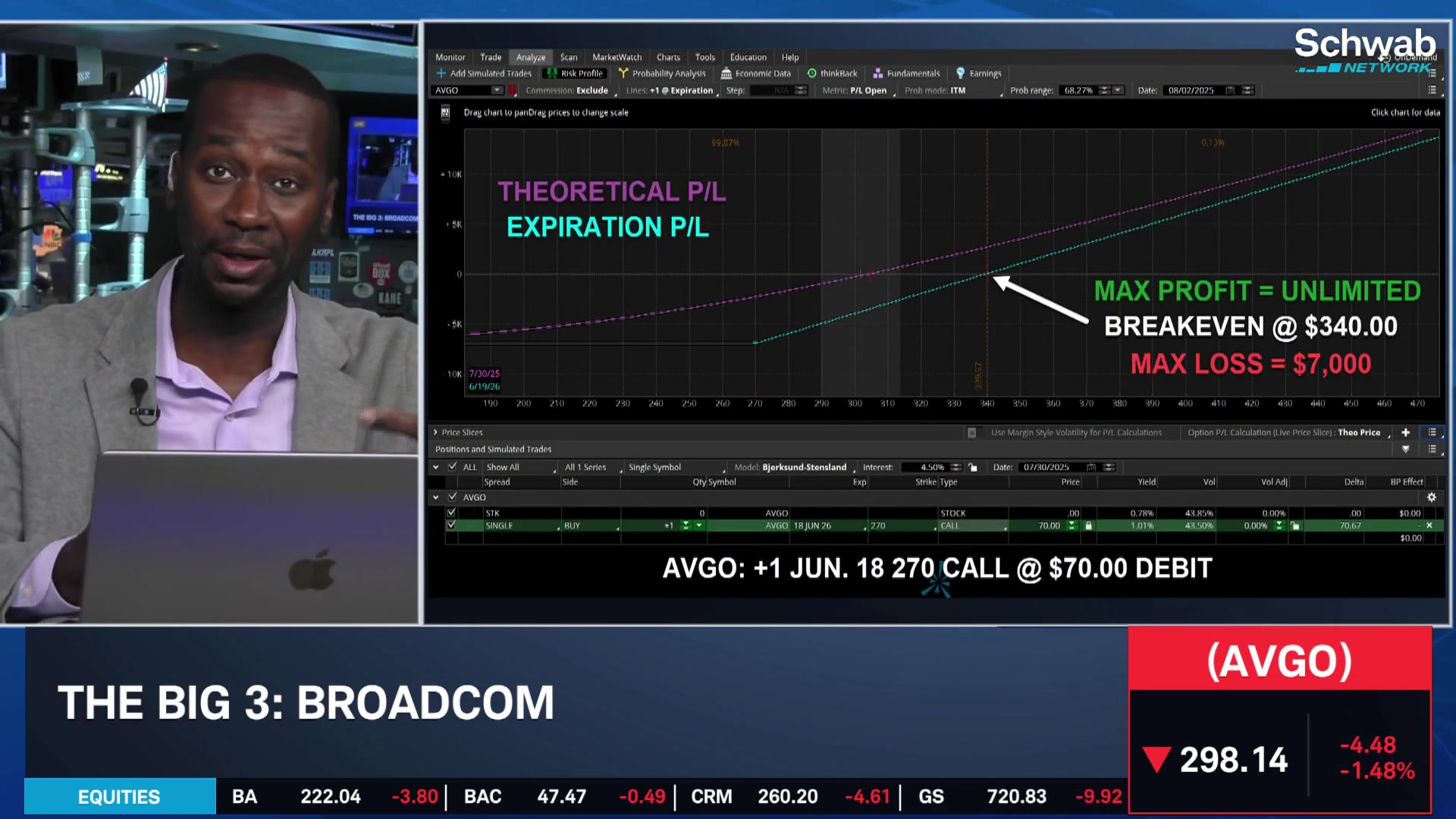

Tech Giants Report: AMZN Stumbles, AAPL Shines, META Surprises, MSFT Soars

MARKET ON CLOSE

► Play video