S&P 500 Climbs on Jobs Strength, Fed Patience

Over the past month, the financial markets have demonstrated remarkable resilience despite a backdrop of heightened macroeconomic uncertainty, ongoing tariff pressures, geopolitical tensions, and mixed signals in the labor market. U.S. equities, anchored by the S&P 500 (SPX) and Nasdaq-100 (NDX), are at record highs, driven by solid corporate earnings, a robust jobs market and soft inflation data.

The U.S. Senate late Tuesday approved a sweeping budget reconciliation package which marries major tax cuts with record-high fiscal spending. At its core, the Senate bill extends components of the 2017 Tax Cuts and Jobs Act. This prolongs corporate tax cuts, extending profitable gains to businesses and improving capital investment into American business.

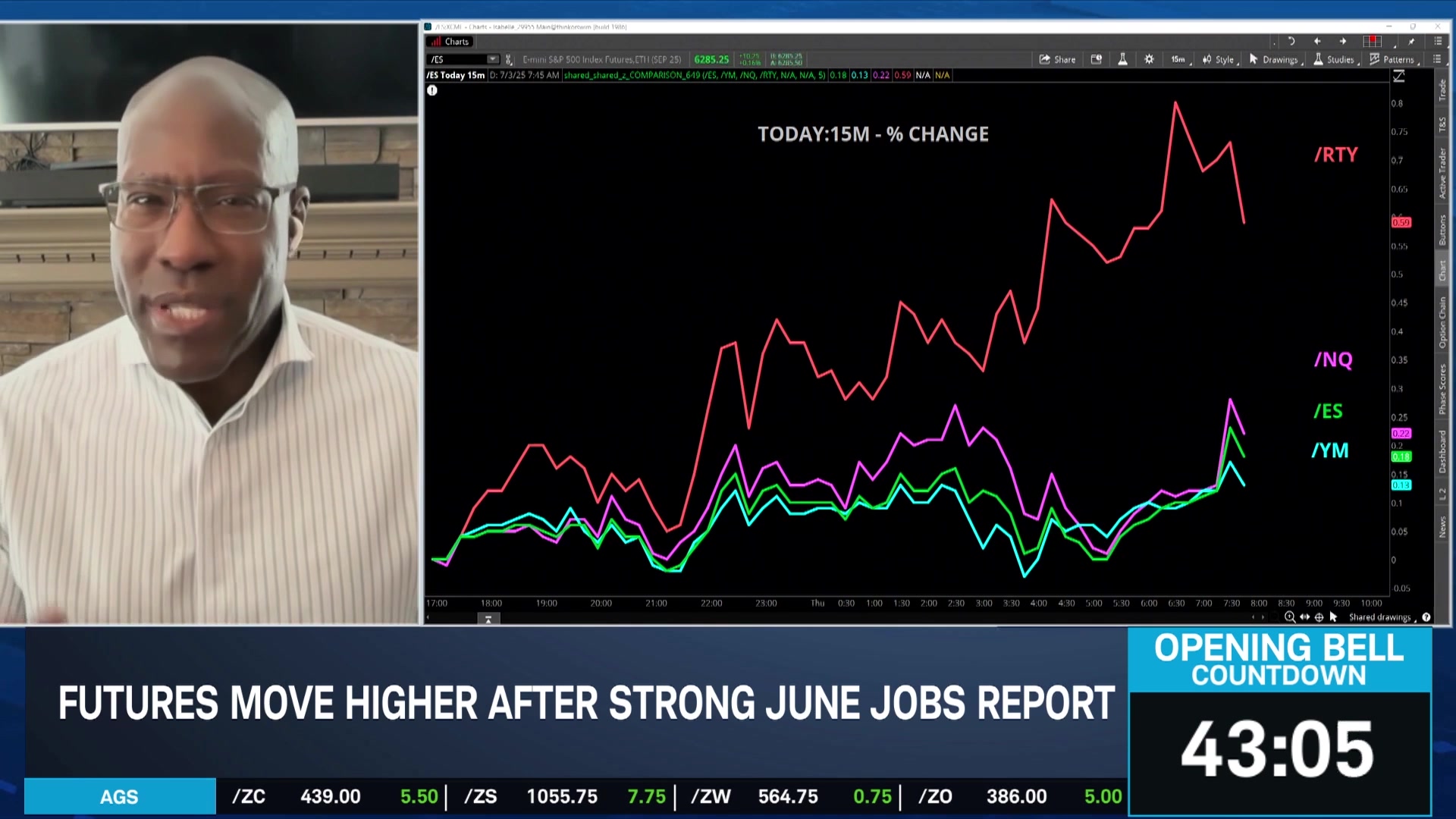

The bill arrives amid mounting concern about the U.S. labor market. ADP data earlier this week showed private employers slashed 33,000 jobs, a potentially troubling red flag, However, the June jobs report demonstrates economic resilience. The U.S. economy added 147,00 nonfarm payrolls in June, more than the 110,000 expected by economists. The unemployment rate unexpectedly fell to 4.1%. Economists had expected the unemployment rate to move higher to 4.3%.

Intersecting with fiscal dynamics and mixed labor data are evolving trade policies. The nation remains under a 90 day tariff pause set to expire on July 9th. A tentative agreement was struck with Vietnam this week, reducing tariffs on Vietnamese exports to the U.S. to 20% (from a higher country-specific rate) and imposing a 40% tariff on transshipments, while Vietnam will admit U.S. exports duty-free. This deal offered a modest lift to Wall Street, as the S&P 500 hit record highs driven by tech and consumer apparel companies such as Nike (NKE).

Overall, equity markets appear placated for now. U.S. Treasury bond yields have retreated from recent highs, and the CME FedWatch Tool is pricing in less than 10% chance of a rate cut in July, with expectations of two cuts before year-end if employment data continues to soften. The U.S. economy continues to defy bearish predictions while broad equity markets trade at all-time highs.

Featured Clips