Nvidia Holds The Market Up

Thomas White

Co-HostU.S. stock futures are slightly higher in premarket trading after the three major indices settled at record highs ahead of the Federal Reserve’s interest rate decision. The Fed is widely expected to cut rates by a quarter point at the conclusion of its meeting this afternoon and traders will be focused on Fed Chair Powell’s comments.

Investors will also watch earnings today with five of the ‘Mag 7’ stocks reporting this week. Alphabet (GOOGL), Meta Platforms (META) and Microsoft (MSFT) are set to report after the close today and Apple (AAPL) and Amazon (AMZN) post results on Thursday.

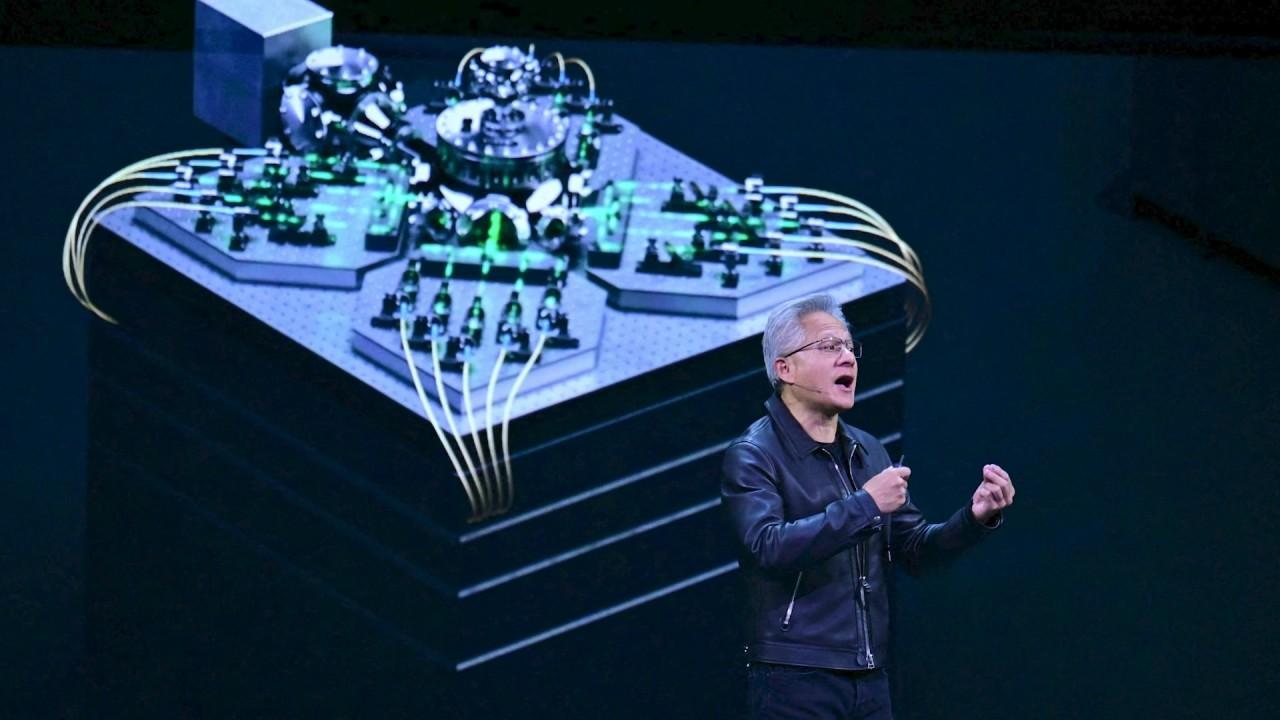

Nvidia (NVDA) shares are at record highs this morning and hit a $5 Trillion market cap after CEO Jensen Huang said Nvidia expects $500 billion in AI chip orders and announced plans to build seven new supercomputers for the U.S. government.

Snapshot (as of 7 AM ET)

- Oil (/CL) – Oil prices are flat near $60.15 a barrel after falling about 2% on Tuesday, marking a third straight day of declines as investors considered the impact of U.S. sanctions against Russia’s two biggest oil companies on global supply, along with a potential OPEC+ plan to raise output.

- Gold (/GC) – Gold prices are up over 1% near $4040 after it slipped to a three-week low on Tuesday as hopes for progress in U.S.–China trade talks dimmed its safe-haven allure, while investors’ focus tipped over to the Federal Reserve’s interest rate decision this week.

- Bitcoin (/BTC) – The Crypto Future is down 0.5% near 113,000 in premarket trading.

- VIX – The CBOE Volatility Index rose 4% on Tuesday and settled at 16.42 despite stocks rising to all-time highs.

- U.S. Dollar (/DX) – The dollar is up slightly at 98.86.

Biggest Premarket Movers - % Change (as of 7 AM ET)

- Teradyne Inc (TER): +20.17%

- Centene Corp (CNC): +10.36%

- Seagate Technology (STX): +6.09%

- Generac Holdings Inc (GNRC): -11.65%

- Mondelez International (MDLZ): -5.00%

- CVS Health (CVS): -3.89%

Economic Data

7:00 AM ET: MBA Mortgage Application

8:30 AM ET: Intl. Trade in Goods, Retail/Wholesale Inventories

10:00 AM ET: Pending Home Sales

2:00 PM ET: FOMC Announcement

2:30 PM ET: Fed Chair Powell Presser

Notable Earnings

Premarket: AER, AEP, ADP, AVT, BLCO, BA, EAT, CAT, CNC, CTSH, CVS, DAN, EQNR, ETSY, FI, FTV, GRMN, GEHC, GNRC, GSK, KHC, MAS, OSK, OTIS, PSX, REYN, UBS, VZ, WSO

Postmarket: AEM, ALGN, GOOGL, BHC, BOOT, CHRW, CP, CVNA, CMG, DVA, EBAY, FMC, KLAC, META, MGM, MSFT, MC, PRU, PSA, ROL, NOW, SFM, SBUX, TDOC, RIG, WEX, WOLF

Premarket Tomorrow: AAP, MO, BUD, APTV, BAX, BIIB, BWA, BMY, BLDR, CAH, CMCSA, COMM, CROX, DTE, LLY, EL, FOXA, HSY, IP, K, KMB, LHX, MA, MRK, QSR, RBLX, SHAK, SO, TEX, TW, TT, VMC, WEC, WLK, XPO

Postmarket Tomorrow: AMZN, AAPL, TEAM, NET, COIN, EW, FSLR, FND, FBIN, GILD, GDDY, ILMN, MSTR, RDDT, RKT, ROKU, SYK, TWLO, WERN, WDC, WY, ZG

Upgrades/Downgrades

- KeyBanc upgrades Skyworks (SWKS) to Overweight from Sector Weight

- Citi upgrades Qorvo (QRVO) to Buy from Hold

- Wolfe Research upgrades Edwards Lifesciences (EW) to Peer Perform from Underperform

- Deutsche Bank downgrades UnitedHealth (UNH) to Hold from Buy

- Canaccord downgrades Kenvue (KVUE) to Hold from Buy

Featured Clips

Charles Schwab and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions.