Morning Watchlist: U.S./China Tensions, OPEC+ Hikes Production

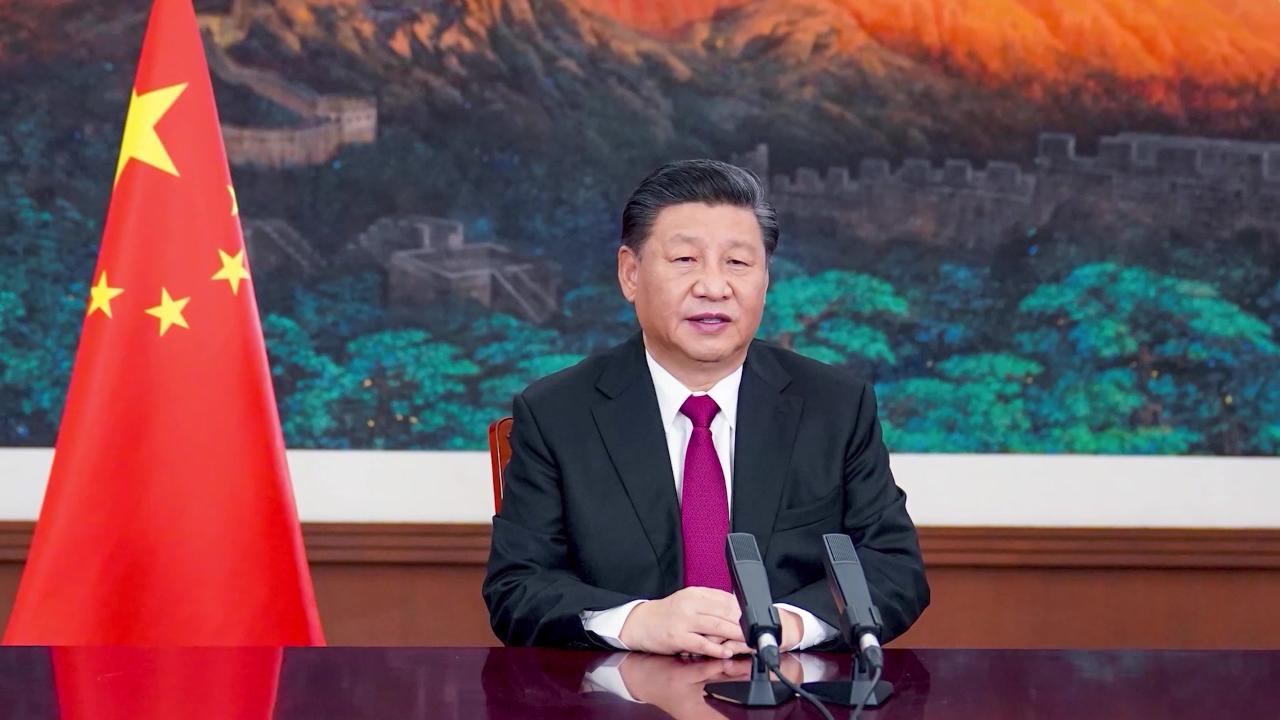

Major equity index futures are modestly lower to start the month of June, as traders must contend with rising U.S.-China tensions and tariff headlines. President Trump last week said China violated the 90-day Trade War truce between the two countries, with Beijing vowing countermeasures after Trump revoked Chinese student visas and halted chip design software exports.

OPEC+ agreed to sharply raise crude oil production during the weekend and seeks a 411,000 barrel/day increase, but crude oil futures are spiking more than +4% this morning after markets continue to assess the damage from a major Ukrainian offensive against Russia and what effect it could have on oil production.

It’s a light day for earnings, but DG, CRWD, and HPE will give quarterly results tomorrow. Economic data on today’s docket includes PMI Manufacturing, ISM Manufacturing, and Construction Spending.

Snapshot (as of 7 AM ET)

- Oil (/CL) – Oil prices are up over 4% despite OPEC+ declaring a production hike after Ukraine launched a major offensive against Russia.

- Gold (/GC) – Gold is up around 2% to $3,380.

- Bitcoin (/BTC) – The crypto future is down around 0.5% to $104.6K.

- VIX – After closing at 18.57 on Friday, the CBOE Volatility Index is up 6% to 19.68 as trade tensions escalate.

- U.S. Dollar (/DX) – The dollar is down 0.5% to 98.8.

Biggest Premarket Movers (Mark % Change as of 7 AM ET)

- Steel Dynamics (STLD): +9.77%

- Nucor (NUE): +9.75%

- Moderna (MRNA): +2.97%

- Alphabet (GOOGL): -2.08%

- Tesla (TSLA): -2.01%

- Super Micro Computer (SMCI): -1.53%

Economic Data

- 9:45AM ET: PMI Manufacturing (Final)

- 10:00AM ET: ISM Manufacturing, Construction Spending

- 10:15AM ET: Fed’s Logan Speaks

- 11:00AM ET: Treasury Buyback Announcement (Prelim)

- 11:30AM ET: 3-Month Bill Auction, 6-Month Bill Auction

- 12:45PM ET: Fed’s Goolsbee Speaks

Notable Earnings

- Premarket: CPB, SAIC, UEC

- Postmarket: CRDO

- Premarket Tomorrow: DG, NIO, OLLI, SIG

- Postmarket Tomorrow: CRWD, HPE, GWRE, HQY, ASAN, BASE, YEXT

Upgrades/Downgrades

- BofA upgrades Boeing (BA) to Buy from Neutral

- Goldman Sachs upgrades Old Dominion (ODFL) to Buy from Neutral

- Jefferies upgrades Rollins (ROL) to Buy from Hold

- Goldman Sachs downgrades Union Pacific (UNP) to Neutral from Buy

- Goldman Sachs downgrades CSX (CSX) to Neutral from Buy

- Bernstein downgrades Charter (CHTR) to Market Perform from Outperform