Morning Watchlist: Another Down Day Ahead?

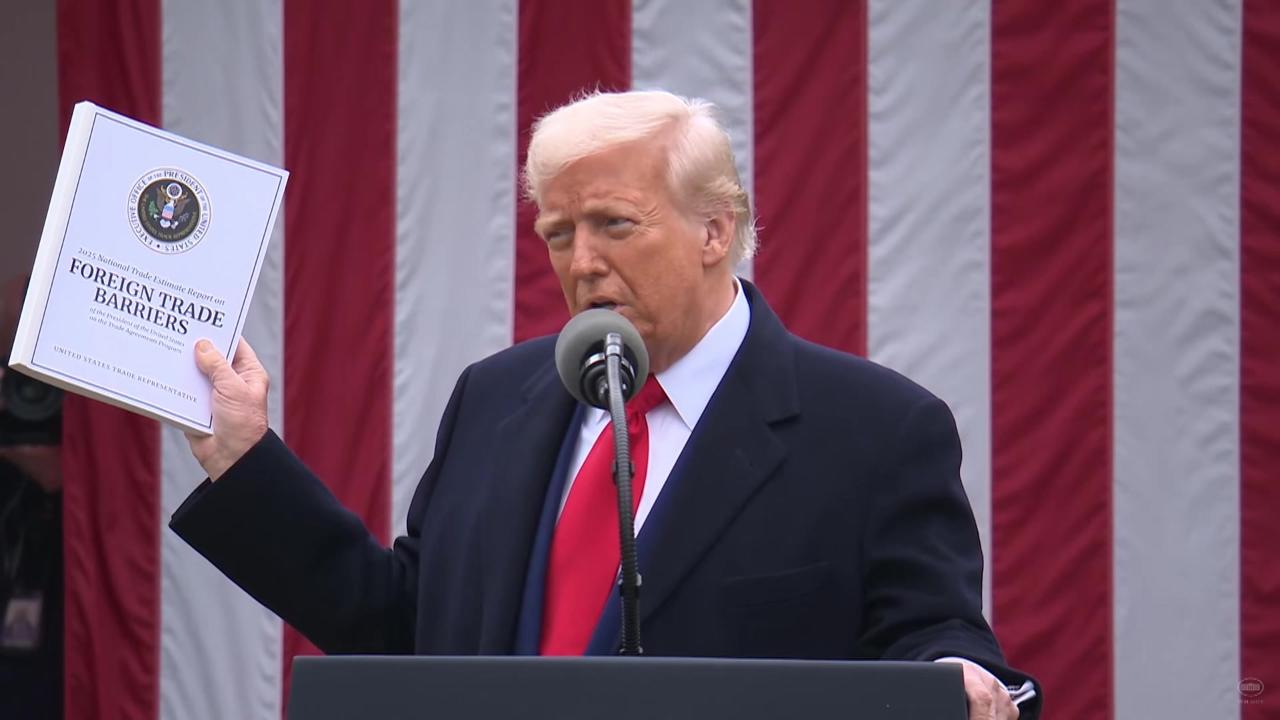

U.S. stock futures are falling in premarket trading, extending the dramatic two-day market collapse triggered by President Donald Trump’s imposition of unexpectedly steep tariffs on major U.S. trading partners. The S&P 500 futures are down 2% in thin trading, but are far off of overnight lows. Despite the market turmoil, Trump and his administration downplayed the sell-off, with the president commenting Sunday evening that downturns are sometimes necessary “medicine” to address deeper issues.

The market’s unease stemmed from the tariffs’ unprecedented scale, which lacked clear objectives, and was compounded by China’s swift retaliation on Friday with a 34% tariff on all U.S. imports. This escalation heightened fears of a broader trade war, further destabilizing financial markets. Volatility is spiking with the CBOE VIX near the 47 level as investors ‘Risk-Off’ mode continues. With little economic data on tap today, focus will be on tariff headlines and any potential for an escalation of the trade war or much needed positive negotiations.

Snapshot (as of 7 AM ET)

- Oil (/CL) – Crude Oil fell 13% on Thursday-Friday of last week, one of the biggest 2-day declines in history. This morning, oil is down 2.5% near $60 a barrel and extending last week’s losses, as escalating trade tensions between the United States and China stoked fears of a recession that would reduce demand for crude.

- Gold (/GC) – Gold prices are slightly higher near $3055 amid a wider market sell-off, continuing their retreat as investors dumped bullion to cover their losses in other trades on fears of a global recession due to an escalating global trade war.

- Bitcoin (/BTC) – The crypto future is down about 9% near 77K in the premarket.

- VIX – The CBOE Volatility Index spiked over 50% on Friday and settled at 45.31 as stocks sold off. The VIX closed at its highest level since April of 2020 and is up again today and is just below the 50 level.

- U.S. Dollar (/DX) – The dollar is flat around 102.7.

Biggest Premarket Movers (Mark % Change as of 7 AM ET)

- Dollar Tree (DLTR): +0.81%

- Viatris (VTRS): +0.13%

- Comcast (CMCSA): +0.06%

- Palantir (PLTR): -8.12%

- Tesla (TSLA): -6.86%

- Super Micro (SMCI): -6.81%

Economic Data

- 11:30AM ET: 3-Month Bill Auction & 6-Month Bill Auction

- 3:00PM ET: Consumer Credit

Notable Earnings

- Premarket: None

- Postmarket: PLAY, GBX, LEVI

- Premarket Tomorrow: RPM, TLRY, WBA, WDFC

- Postmarket Tomorrow: CALM

Upgrades/Downgrades

- Raymond James upgrades JetBlue (JBLU) to Outperform from Market Perform

- Redburn Atlantic upgrades Roku (ROKU) to Buy from Neutral

- Morgan Stanley upgrades Bank of America (BAC) to Overweight from Equal Weight

- UBS downgrades United Airlines (UAL) & Delta Airlines (DAL) to Neutral from Buy

- Baird downgrades Target (TGT) and Starbucks (SBUX) to Neutral from Outperform

- Morgan Stanley downgrades Goldman Sachs (GS) to Equal Weight from Overweight