Meta (META) & Microsoft (MSFT): Record Highs as Earnings Impress

Meta Platforms and Microsoft both delivered quarterly results this week that topped already-high expectations, sending shares of each tech titan to fresh all-time highs. With artificial intelligence still the centerpiece of corporate strategy, investors appeared satisfied with continued momentum in both top-line growth and margin expansion.

Meta Surges on Strong Ad Performance and AI Investment

Meta reported Q2 revenue of $47.5 billion, above the high end of its prior guidance and a 22% increase year over year. Earnings per share came in at $7.14, beating consensus estimates and marking a 38% jump from the same period last year.

Advertising strength remained the key driver, with robust demand across Instagram and Reels. CEO Mark Zuckerberg also highlighted “meaningful progress” in monetizing Meta AI tools, which are now integrated across WhatsApp, Messenger, and Threads. Daily Active People (DAP) rose 6% YoY to 3.48 billion.

Meta’s capital expenditures reached $17.01 billion in Q2—reflecting continued infrastructure buildout for AI training and deployment. The company reaffirmed full-year capex guidance in the range of $66-$72B.

Shares of Meta climbed more than 11% post-earnings and pushed through previous resistance levels. It’s now trading near $770.

Microsoft Rallies on Cloud and Copilot Strength

Microsoft (MSFT) also delivered a beat on both top and bottom lines. Revenue for the fiscal fourth quarter totaled $76.4 billion—up 18% YoY—while earnings per share rose 24% to $3.65.

The closely watched Azure division posted a 39% rise in sales during Microsoft’s fiscal fourth quarter, the company said in a statement while analysts projected a 34% increase. Cloud growth is benefiting from accelerated adoption of Copilot AI tools across Microsoft 365 and enterprise offerings. CEO Satya Nadella said the company is “scaling the AI era“ by embedding copilots in every product category.

Operating margins ticked up to 45%, aided by a strong product mix and disciplined expense management. Commercial bookings rose 37%, and forward guidance pointed to continued double-digit revenue growth into FY26.

Microsoft shares rose nearly 5% after the report, above $530.

Outlook: High Expectations, Higher Highs

Heading into earnings, both stocks were already priced for near perfection, trading at premium multiples and leading the S&P 500’s tech-heavy rally. But with AI execution delivering tangible returns, investors showed renewed confidence in continued upside.

The bar remains high, but for now, both companies cleared it with room to spare.

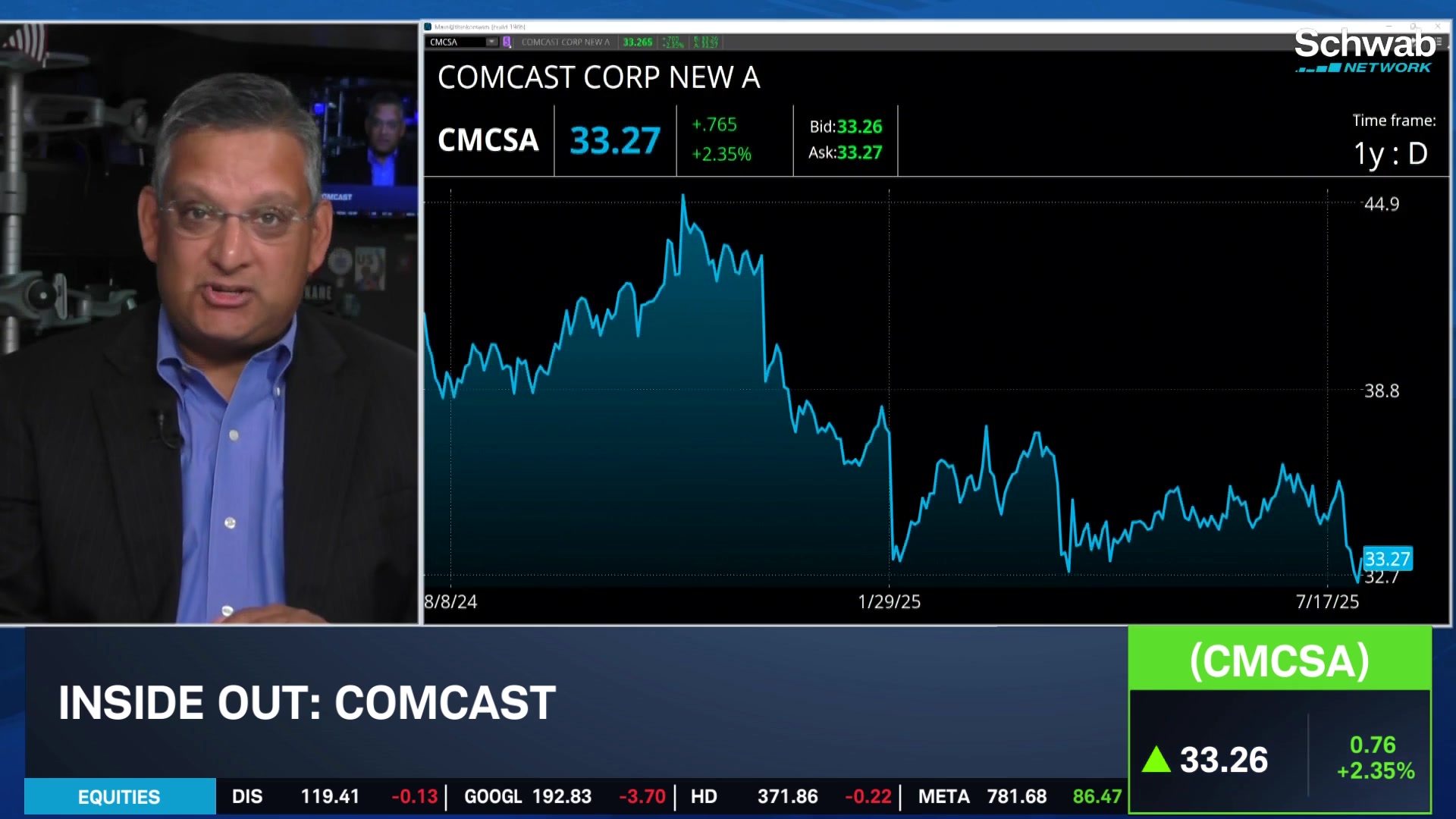

Featured clips

Charles Schwab and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions.