Markets Stall Post A.I. Deal Announcements

Rick Ducat

ContributorMarkets are poised for a lower open, with S&P 500 futures down about -0.53% continuing a two-day slide after Monday’s all-time highs.

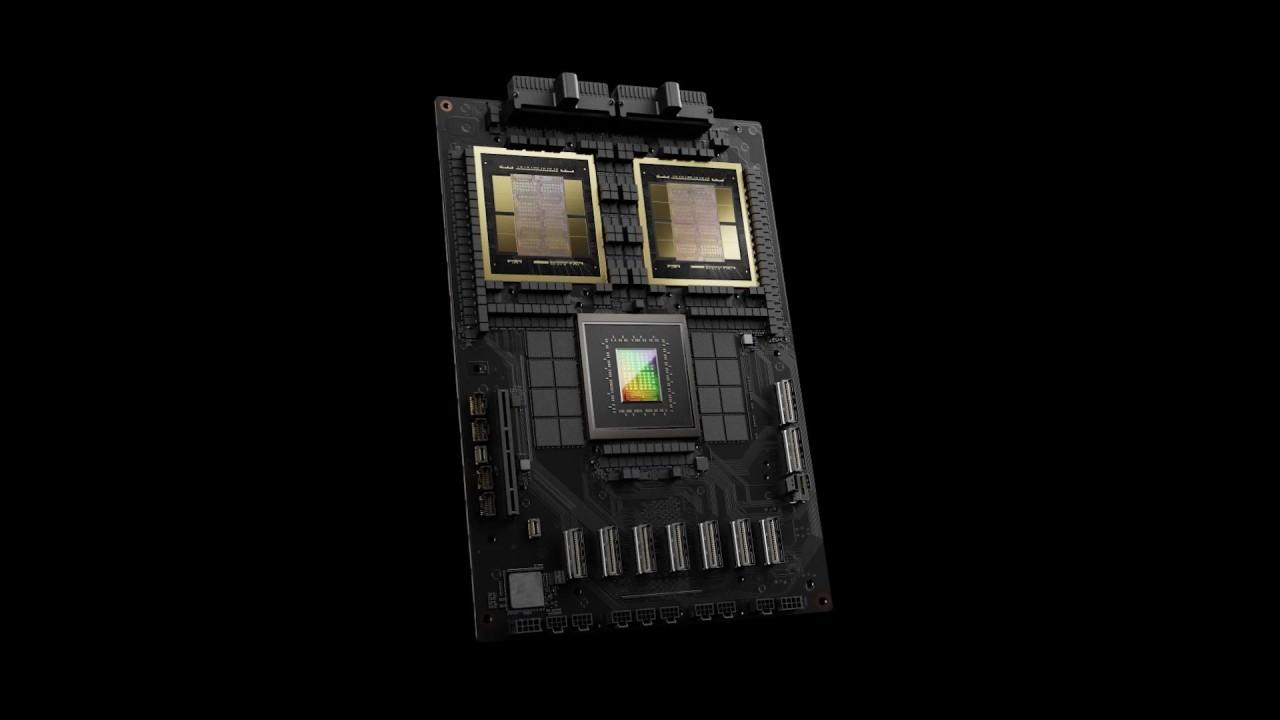

Barclay’s said Nvidia (NVDA) could still rally 30% as artificial intelligence dealmaking continues to ramp up, and raised their price target to $240 from $200.

Meanwhile, Starbucks (SBUX) said it will close stores and eliminate about 900 jobs as part of a $1B restructuring plan.

Earnings are light with the only notable company for the rest of the week being Costco (COST), but it’s a heavy economic data day; the list includes Jobless Claims, Durable Goods, Existing Home Sales, and a full slate of Fed speakers throughout the day.

Snapshot (as of 7 AM ET)

- Oil (/CL) – Oil Futures are down 0.75% around $64.50 a barrel as markets determine the extent of how impactful supply disruptions in Russia impact global inventories.

- Gold (/GC) – Gold is flat near 3,768, still near its recent all-time high of around 3,824 after yesterday’s decline.

- Bitcoin (/BTC) – The cryptocurrency futures are down about -2.15% around 111,680, giving back all of yesterday’s +1.3% gain but remaining above yesterday’s lows.

- VIX – VIX retreated to close at 16.18 from yesterday’s close of 16.64 but has moved higher in pre-market trading to 17.36.

- U.S. Dollar (/DX) – The greenback is up 0.32% near 98.18 after yesterday’s +0.7% upside push.

Biggest Premarket Movers (Mark % Change as of 7 AM ET)

- IBM Corp (IBM): +2.79%

- Intel Corp (INTC): +1.70%

- Albemarle Corp (ALB): +1.56%

- CarMax (KMX): -16.84%

- Jabil Inc (JBL): -4.56%

- Oracle (ORCL): -3.65%

Economic Data

- 8:30AM ET: International Trade in Goods (Advance), Jobless Claims, Wholesale Inventories, GDP

- 10:00AM ET: Existing Home Sales, Michelle Bowman Speaks

- 11:00AM ET: Kansas City Fed Manufacturing Index

- 1:00PM ET: Michael Barr Speaks, 7-Yr Note Auction

Notable Earnings

- Premarket: JBL, KMX, BB

- Postmarket: COST

- Premarket Tomorrow: n/a

- Postmarket Tomorrow: n/a

Upgrades/Downgrades

- BNP Paribas Exane upgraded Arista Networks (ANET) to Outperform from Neutral

- Scotiabank upgraded CrowdStrike (CRWD) to Outperform from Sector Perform

- Citi upgraded CME Group (CME) to Buy from Neutral

- Berenberg downgraded TotalEnergies (TTE) to Hold from Buy

- Scotiabank downgraded Freeport-McMoRan (FCX) to Sector Perform from Outperform

- Needham downgraded Lululemon (LULU) to Hold from Buy

Charles Schwab and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions.