Markets Hold Near Highs as Earnings, Housing Data, and Fed Signals Compete for Attention

Over the past few trading sessions, U.S. equity markets have continued their upward march even as global sentiment becomes increasingly cautious. Yesterday, modest gains in AI related stocks, led by Alphabet (GOOGL), lifted the S&P 500 and Nasdaq Composite to new intraday and closing highs. Alphabet rose roughly 1% on stronger than expected earnings and an additional $10 billion investment in AI, while Tesla (TSLA) shares dropped sharply following warnings of challenging quarters ahead.

Despite the mixed underlying corporate trends, the S&P 500 closed at approximately 6,363.35 and the Nasdaq Composite also reached a fresh high, while the Dow Jones Industrial Average slipped around 0.7% to 44,693.91. Small cap sentiment is mixed with the Russell 2000 up 3.5% in July, yet it remains roughly flat year to date and is substantially lagging the S&P 500.

As broad markets set fresh records, housing data has painted a more cautious picture of the broader economy. In June, Existing Home Sales dropped 2.7% to a seasonally adjusted annual rate of 3.93 million units and the median existing‑home price climbed to a record $435,300, up 2% from a year earlier. Inventory rose to a 4.7‑month supply, though still below the equilibrium five‑to‑six‑month mark.

New Home Sales were sluggish as well with a reported modest 0.6% increase to 627,000 units in June, but the level remained 6.6% below the pace of a year earlier, while inventory surged to a 9.8‑month supply. The housing market has certainly felt the effects of higher interest rates most acutely with existing home sales in decline, pending home sales near record lows, and mortgage rates elevated. Despite 1% interest rate cuts by the Federal Reserve between September and December of 2024, mortgage rates remain above 6% influenced by longer-term bond yields which remain elevated.

As markets look toward August, attention will turn to the upcoming Jackson Hole Symposium, where Fed officials are expected to clarify their outlook on inflation, growth, and monetary policy. With valuations still stretched in some corners of the market, and global trade and fiscal tensions simmering beneath the surface, investors appear poised for a more volatile second half. The next major catalysts will likely come from the July jobs report and inflation data due in early August, both of which may help determine whether this market continues to grind higher or enters a more corrective phase.

Featured Clips

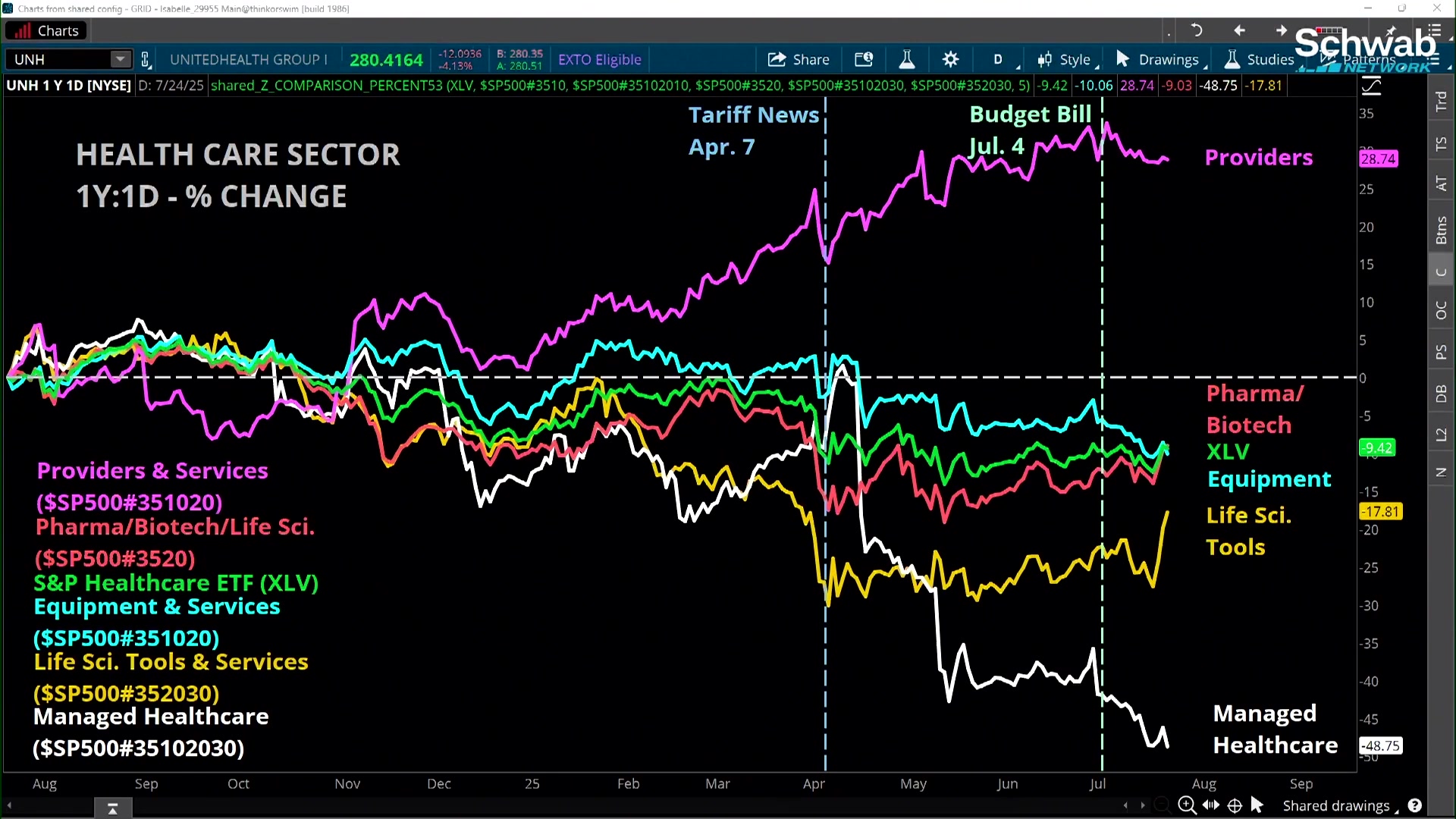

UNH Continues 50% Y/Y Sell-Off: Key Levels & Options in UNH & Healthcare

MARKET ON CLOSE

► Play video

Palumbo: GOOGL to Reach $250, AMZN AWS "Rockin' and Rolling," Expect Tariff Volatility

THE WATCH LIST

► Play video