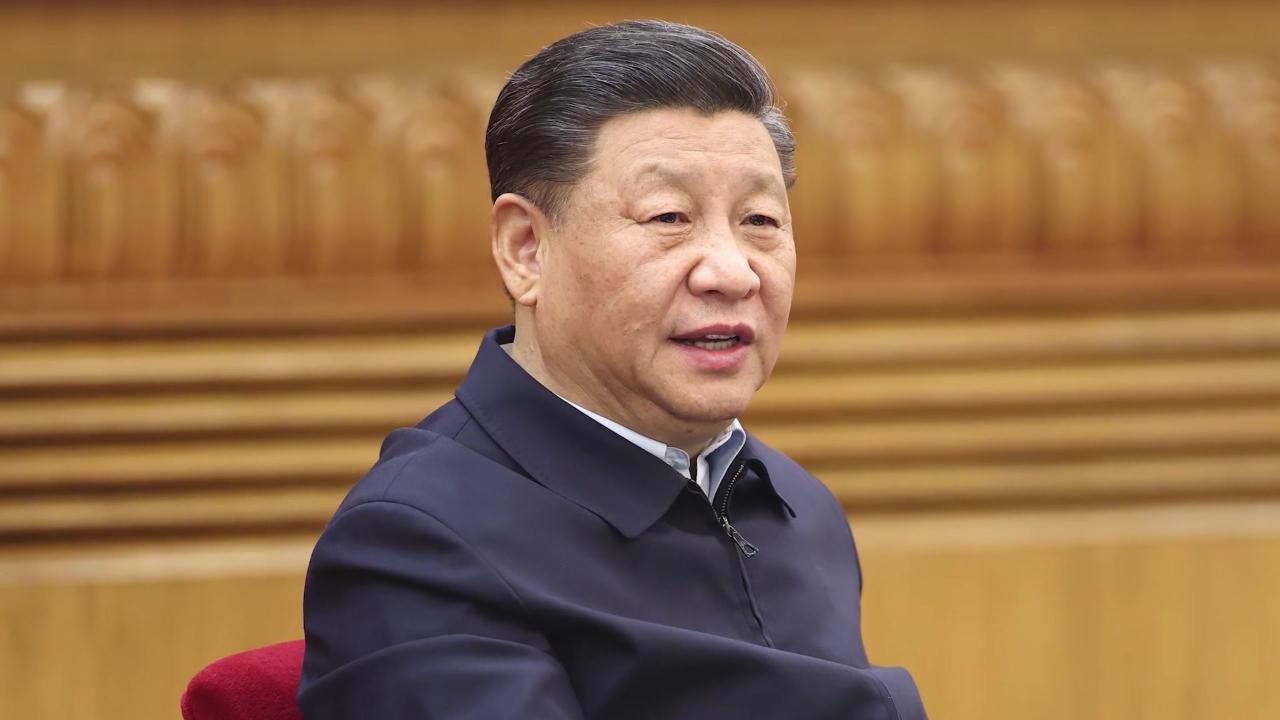

Market Minute: U.S./China Tensions Rise, Pressuring Markets

The major indices look like they’ll open in the red this morning after we saw some escalation in U.S./China relations over the weekend.

Last Friday, President Trump accused China of violating the Geneva trade agreement, which is the agreement to suspend most tariffs for 90 days. On social media, he wrote that “China, perhaps not surprisingly to some, HAS TOTALLY VIOLATED ITS AGREEMENT WITH US.”

This is potentially due to China’s unwillingness to open exports of rare earths, with U.S. Trade Rep Jamieson Greer accusing them of violating their pledges. Rare earths are a major issue at hand in the trade war, as they are critical to semiconductor manufacturing. The Center for Strategic International Studies claims China “produces 60% of the world’s rare earths but processes nearly 90%.”

Now China is accusing the U.S. of violating the deal as well, citing export restrictions on semiconductors and chemicals, along with revoking visas for Chinese students.

A Chinese commerce department spokesperson said the U.S. is “unilaterally [provoking] new economic and trade frictions, increasing the uncertainty and instability in the bilateral economic and trade relations.”

It’s unclear how talks will progress from here. Bloomberg reports that White House economic advisor Kevin Hassett expects a call between Jinping and Trump this week.

But in addition to trade, tensions are escalating around defense. Defense Secretary Pete Hegseth announced the U.S. is “reorienting toward deterring aggression by Communist China…The threat China poses is real, and it could be imminent.” China has long wanted to absorb Taiwan, which is an important strategic partner of the U.S. and a hub of semiconductor manufacturing. It has ramped up naval military exercises in the last few years, troubling its neighbors. China fired back, calling Hegseth’s remarks “Cold-War mentality” and “severely challenging China’s sovereignty and rights.”

Markets look a little nervous as we open the month of June, with major indices dipping into the red and the VIX spiking. Also keep an eye on oil, as the Ukrainian assault on Russia spiked oil prices despite OPEC+ announcing yet another output hike.

Tune into the Schwab Network for the latest news and more!

Featured Clips

DELL, NVDA & TSLA Technicals to Watch, Investor Focus Moving to Economy

MARKET ON CLOSE

► Play video

Pfizer (PFE) CEO on Braftovi Reducing Colorectal Cancer Death Risk 'in Half'

MORNING TRADE LIVE

► Play video