Market Minute: Tariff Relief Fuels Market Rally

The highly anticipated meeting between the U.S. and China over the weekend has delivered positive news for equity markets, as both countries agreed to reduce reciprocal tariffs to 10%. However, the U.S. will maintain fentanyl-related import tariffs at 20%, keeping the average tariff rate on Chinese goods at approximately 30%. This reduction is seen as a goodwill gesture to continue negotiations and acknowledges the unsustainable nature of the previous, more restrictive tariff levels. The new tariff rates will take effect on Wednesday, May 14th, and remain in place for 90 days.

It's not just equities reacting positively—commodities are also rallying on the reduced risk of a global economic slowdown. WTI crude has broken above the $60 level and is on pace to test $65, a key profitability threshold for refining and drilling, according to industry analysts. Gasoline futures are up more than 2% on the session and are now within 8% of year-to-date highs. Meanwhile, soybean and soybean oil futures—two of China’s most heavily imported agricultural commodities—are also posting strong gains, fueled by hopes of rising export demand. These markets have been under pressure due to high domestic inventories and increased competition from Argentina and Brazil.

Treasury yields are climbing in a classic risk-on response, with the 10-year yield approaching the 4.5% level.

What’s Next?

Treasury Secretary Scott Bessent stated that he plans to continue discussions with his Chinese counterparts in the coming weeks. Similar to the first Trump administration, a potential near-term outcome could be the signing of non-binding purchase agreements—symbolic wins for both countries, though difficult to enforce in practice.

It remains unclear whether the administration aims to pursue a comprehensive trade deal requiring Congressional approval. If that is indeed the objective, negotiations could stretch over an extended period.

For now, however, markets are treating these developments as a clear positive, fueling a broad risk-on rally.

Featured Clips

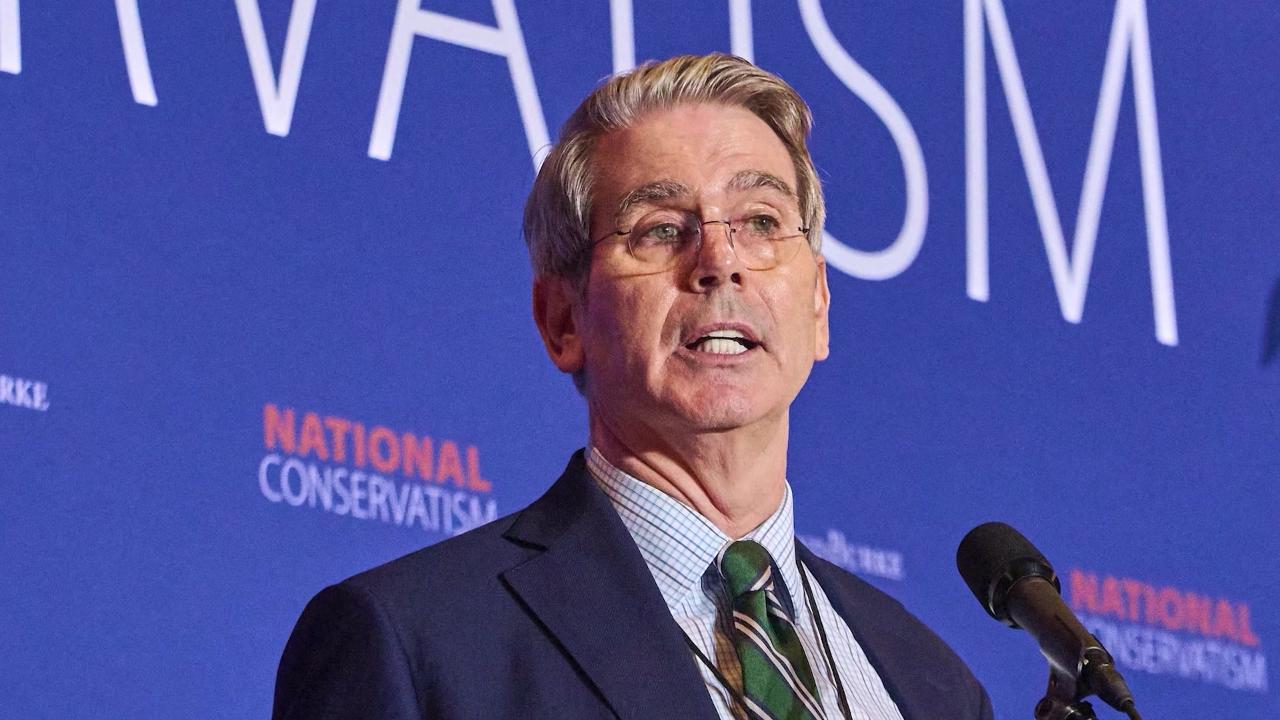

Smith: We’ve ‘Barely Started’ Trade War, ‘Delusional’ That Rates will Fall

THE WATCH LIST

► Play video