Market Minute Overtime: Market Volatility

Volatility has cooled, but it remains a headline driven market and none knows that more so than Schwab Asset Management CIO Omar Aguilar, who studies behavioral finance. He pointed out that humans tend to put more emphasis on news of the day, the week, or even the month and react to that – hence the recent whipsaws we have seen on Wall Street. Another recent trend he noted is home bias, which can come into play during times of volatility, meaning turning to sectors and brands you know the most or bring the most comfort.

Chief Global Investment Strategist Jeffrey Kleintop examined the global fallout from U.S. tariffs, noting that while major institutions like the IMF and World Bank have revised global GDP growth down, investors should look beyond theoretical models. He explained how companies are already circumventing tariffs through strategies like transshipping, meaning shipping to a country with fewer tariffs where that company may have operations.

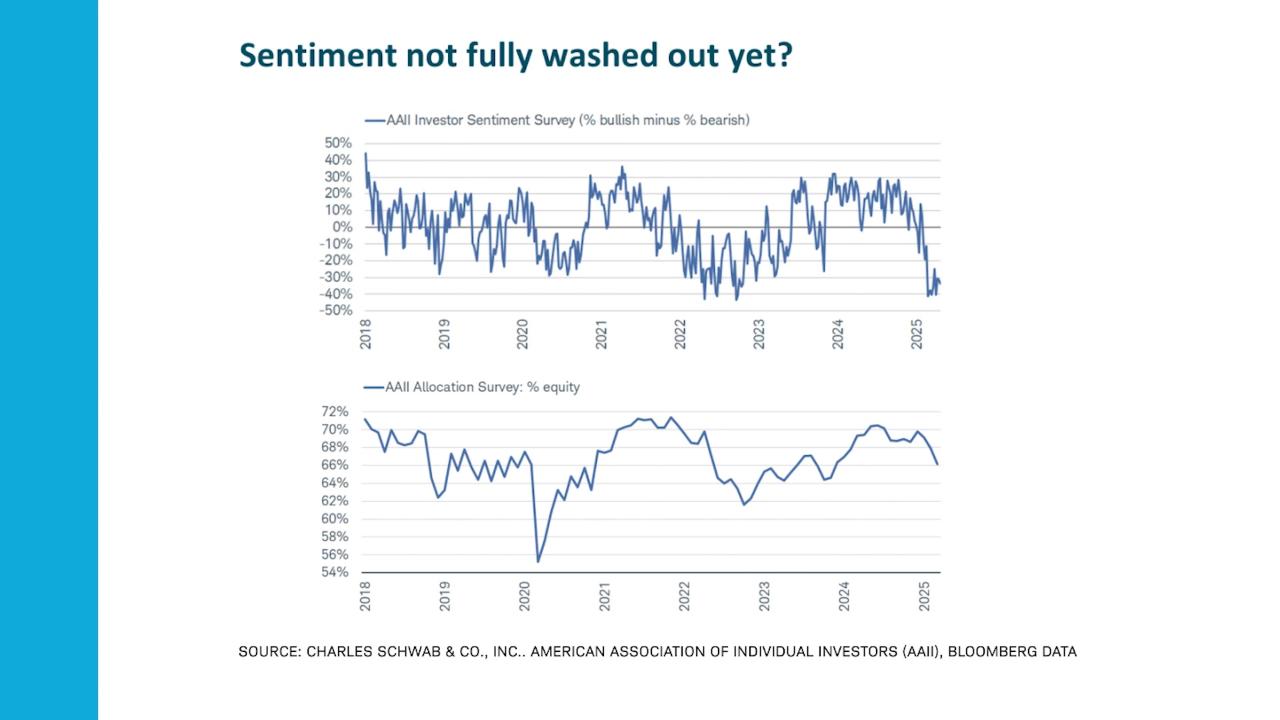

Chief Investment Strategist Liz Ann Sonders and Chief Fixed Income Strategist Kathy Jones addressed the rising risk of recession, the Fed’s cautious stance, and investor sentiment. Sonders noted a surge in earnings estimate downgrades, which has come down from expectations of 15% growth this year to about half of that. Sonders also point out sentiment disconnects between what investors say in surveys and what they actually do. Jones added that the Fed remains in wait-and-see mode due to tariff uncertainty. Despite recent dollar and bond market turbulence, both experts pointed to pockets of opportunity, Jones pointing to munis as an opportunity for investors in a higher tax bracket living in high tax states.

Finally, Managing Director of Legislative and Regulatory Affairs Mike Townsend gave a Washington perspective, noting an unprecedented volume of executive orders and the economic ripple effects of sweeping tariff policies. He highlighted the disconnect between aggressive White House action and lagging Congressional output, with lawmakers facing mounting pressure from constituents. Townsend underscored that the 10% baseline tariffs already in effect represent the most significant shift in U.S. trade policy in a century, and markets are just beginning to price that in.

Featured Clips

Charles Schwab CEO on Volatility, National Investing Day & Ringing Closing Bell

MARKET ON CLOSE

► Play video