Market Minute: Moody’s Downgrade Gives Market a Reason to Sell

Moody’s downgraded the U.S. sovereign credit rating from Aaa to Aa1 last Friday after the close. The downgrade was based on increased government debt and higher interest payment ratios compared to other countries with similar ratings. Moody's expressed concern that federal deficits would continue to widen, potentially reaching 9% of GDP by 2035 due to rising interest payments. Markets are reacting to the news, with equity markets under pressure early in the trading session and long-duration yields rising. The 10-year Treasury futures (/10Y) crossed above 4.5% in overnight trading, while the 30-year Treasury, which is bearing the brunt of the pressure, crossed above 5.00%. Given the historic run for the S&P 500 over the last month, this event may provide traders with a reason to sell, though it may not be the only factor contributing to the equity sell-off.

For context, Moody’s is the last of the major credit agencies to downgrade U.S. debt. In 2011, S&P downgraded U.S. sovereign debt from AAA to AA+, which led to an aggressive sell-off in equities as the market was blindsided by the change. On August 1, 2023, Fitch also downgraded U.S. credit, resulting in an over 8% pullback in the S&P 500 from peak to trough following the announcement. Could we see a similar reaction this time? Possibly, but this downgrade has been on the horizon for some time. Traditionally, lower credit ratings may lead to lower demand for sovereign credit, which could result in higher yields to "clear" the available supply of credit in the market. However, it's important to note that large pension funds and institutional investors typically do not benchmark their holdings of U.S. credit based on a single rating agency. Instead, they consider a blend of ratings from the three major agencies. In this sense, Moody’s has now aligned itself with S&P and Fitch. While short-term volatility may impact Treasury products, it’s unlikely that we will see a structural shift in positioning over the long term.

This brings us to the notion of the market having a “reason to sell.” Such events typically occur when markets have moved aggressively higher, and traders see a reason to take profits. Outside of the immediate volatility in the yield space, bears may need more news to justify aggressively selling off the market. For this week, economic data is relatively light in terms of potential impact, but a slew of Fed speakers are expected to comment on the recent downgrade. For example, Atlanta Fed President Raphael Bostic remarked earlier this morning that the Moody’s downgrade "will have implications for the cost of capital and could ripple through the economy."

Featured clips

NFLX Valuation Concerns, RDDT A.I. Disruption Woes, DAL & UAL Upgrade

Morning Trade Live

► Play video

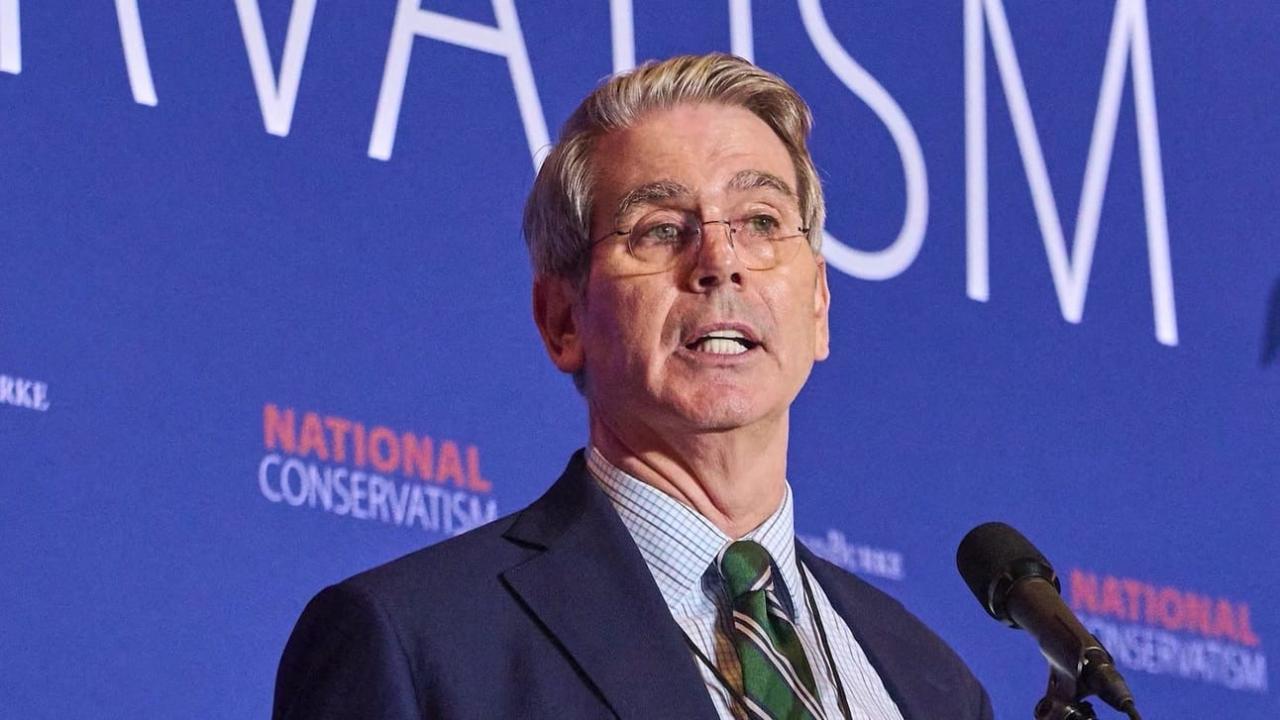

Feinseth: Cruise Lines 'Buy Opportunity,' Expect Smooth Sailing for Growth

Morning Trade Live

► Play videoCharles Schwab and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions.