Market Minute: Mag 7 In Focus with AAPL & AMZN Earnings Today

Apple (AAPL) and Amazon (AMZN) will report earnings in today’s postmarket session, as the broader market looks poised for a higher open on the heels of yesterday’s earnings beats from two more Magnificent 7 members; Meta Platforms (META) and Microsoft (MSFT).

AAPL is down about -1.4% this morning, backing off a bit after yesterday’s rally moved shares above the previous highs of 212.94 from Mar. 14. Price has broken above a downward trendline beginning with the Feb. 25 highs and has so far held on to support at its 21-day Exponential Moving Average, currently near 206 based on yesterday’s close.

Traders may be looking for potential resistance near the confluence of the 63-day EMA and the -1 Standard Deviation Channel, presently near 216. Beyond that, the initial trade war gap downward begins near 221, so this could be another key level to watch. To the downside, the -2 Standard Deviation Channel and the Aug. 5 lows line up near 196-198.

AMZN, on the other hand, is up more than 3.7% in early trading. Much like Apple, price broke out from its own downtrend that began with the all-time highs on Feb. 4 but seemed to falter near the yearly Volume Profile Point of Control (area of heaviest trading) around 188. However, the after-hours rally brings it above the previous highwater mark and the heavy volume area centered around the Point of Control.

Bulls may be eyeing the confluence of the -1 Standard Deviation Channel and the 252-day EMA near 193 for an upside area to consider, with volume picking up again near the 200 mark. To the downside, the -2 Standard Deviation Channel near 174 could provide support if a retest of the old trendline is broken once again.

Featured Clips

'Three Steps Forward, Two Steps Back:' Path to Higher Markets Through Tariffs

MARKET ON CLOSE

► Play video

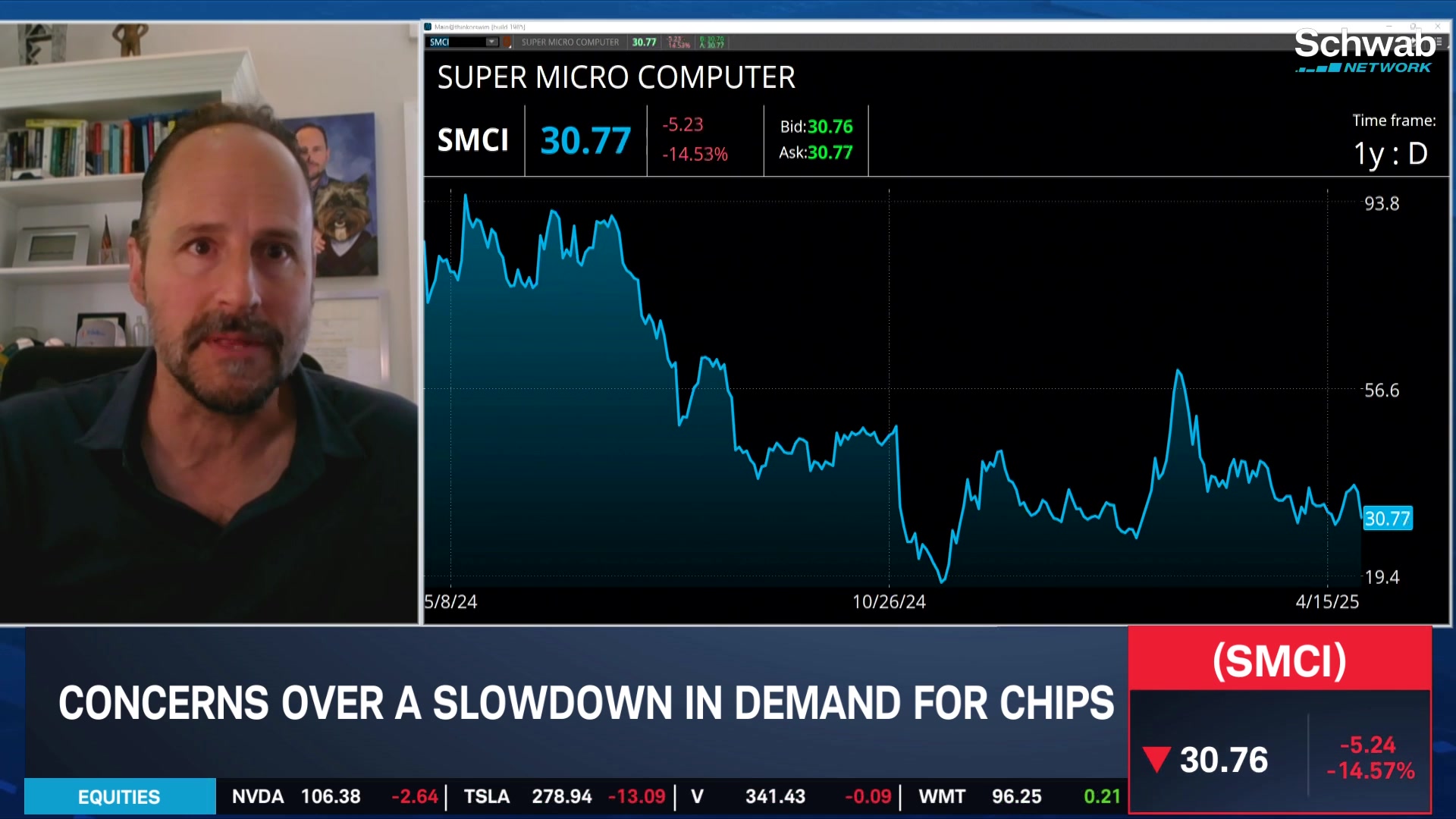

Tuttle: SMCI 3Q Earnings 'Timing Issue Over Demand,' NVDA Blackwell to Aid 4Q

TRADING 360

► Play video