Market Minute: Chipotle Serves Up Earnings As Market Rallies

Chipotle Mexican Grill (CMG) is set to report earnings in today’s postmarket session against the backdrop of a tumultuous trading environment in which the broader market saw another whipsaw move as stocks rebounded from Monday’s selloff and continue to push upward. Shares of the fast-casual restaurant are up about +3.4% in today’s premarket but have fallen about -19.2% during the past year and are still far underperforming both the Consumer Discretionary sector (+7.8%) and the S&P 500 as a whole (+4.2%). In terms of earnings estimates, the Street expects CMG to report EPS of $0.26 and revenue of $2.94B.

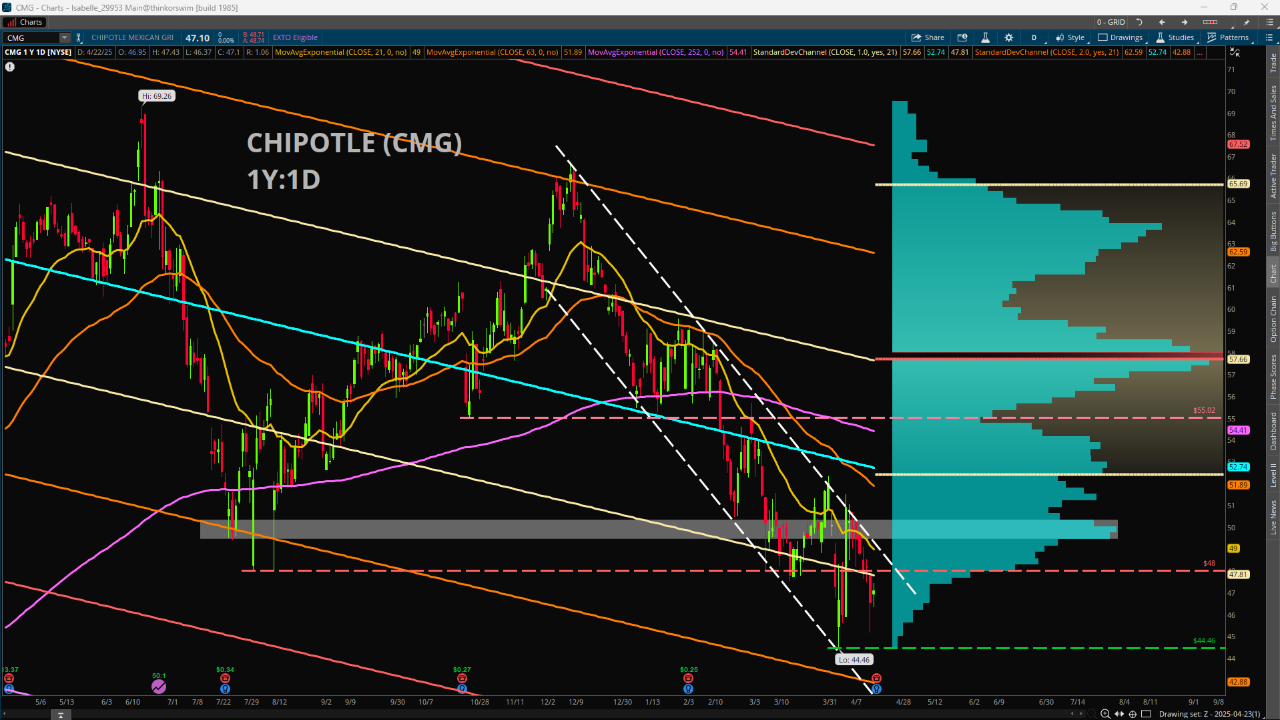

Chipotle closed yesterday at 47.10, which is not far from its 52-week lows of 44.46 on Apr. 7 during the tariff news-related bedlam. But price held above this key level during Monday’s selloff, so it remains an important downside area to watch for potential support if earnings are a miss. Overall, there are few signs that the trend is doing anything to break out of the downward channel pattern beginning with the highs near 66 on Dec. 12. Many common moving averages are trending down with the shorter-length ones continuing to diverge from the longer-length ones, which suggests the downside trend has not changed. Momentum recently showed some bullish divergence from mid-March to early April according to the Relative Strength Index (RSI); however, this may be misleading, as RSI commonly slows down heading into known event risk situations like earnings with potentially high levels of uncertainty.

If price continues to rally, resistance could be found near the confluence of the 21-day Exponential Moving Average and the previously mentioned downward trendline near 49-50. Beyond that, look for a push beyond 55, which previous marked a notable low point in October before the eventual break downward. For support, the lows of 44.46 are the most obvious place to start looking, with the yearly -2 Standard Deviation Channel coming in just below 43. On a longer-term five-year weekly chart, the Volume Profile study shows a relatively large node between 41-42, so this could be a further area to watch for support.

Featured Clips

Vermeulen: Market ‘Ready for a Dead Cat Bounce,’ S&P 500 Can Fall Another ‘37%’

TRADING 360

► Play video

Westly: TSLA 'Quadruple Whammy' in Earnings, Needs to Prove Tech Capabilities

MARKET ON CLOSE

► Play video