July Jobs Data Misses and Revisions Fall – Rate Cut Due?!

The July 2025 nonfarm payrolls report has delivered a significant blow to the notion of a robust U.S. labor market, raising the prospect of potential Federal Reserve interest rate cuts later this year. The report revealed a substantially weaker jobs picture than anticipated, with only 73,000 nonfarm payrolls added in July, according to the Bureau of Labor Statistics (BLS). This fell considerably short of the 110,000 jobs economists had predicted, according to FactSet.

The elephant in the room and what caused the equity sell-off on Friday were the revisions. The BLS also announced substantial downward revisions to prior months' data, erasing a combined 258,000 jobs from May and June. May's figures were revised down to 19,000 from 144,000, and June's to 14,000 from the initial 147,000 reported.

Adding to the somber outlook, the unemployment rate ticked up to 4.2% in July, matching economist expectations but reflecting a slight increase from the 4.1% in the previous month.

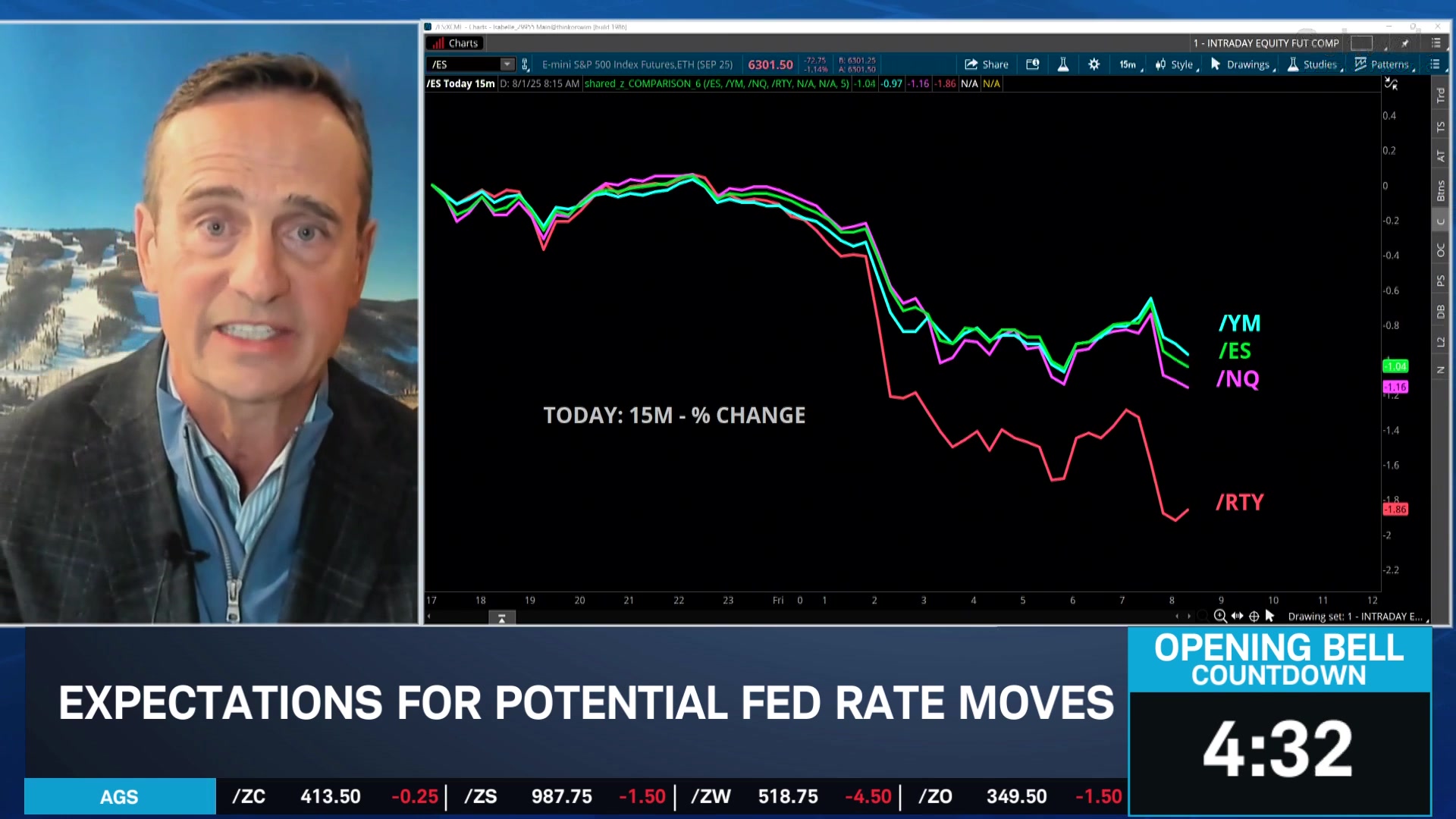

This notably weaker-than-expected jobs report, especially the significant revisions, suggests a considerable cooling of the U.S. labor market, potentially impacting the Federal Reserve's monetary policy decisions. The Fed left rates unchanged this week at 4.25-4.5% and did not signal any indication of a rate cut in September, which the market was anticipating.

The probability of a 25-basis point rate cut in September has surged above 80%, up from 40% just a day prior, according to the CME FedWatch tool. The Fed was just pounding the table on a robust jobs market on Wednesday but now the cracks are starting to show. Along with the slide in equities on Friday, bonds caught a bid and the inverse yields fell sharply. The 10-Year Yield was near 4.4% before the Jobs data and fell near 4.25% on Friday.

The Fed vote was 9-2 in favor of standing pat on interest rates. The two dissenters, Michelle Bowman and Christopher Waller, cited a weaker job outlook and their sentiment came to fruition with the downbeat payrolls data. It seems that Fed will continue under the gun until the September meeting along with the President’s rhetoric that they are too late in potential cuts. While July was positive for stocks and volatility waned, August is setting up to reflect more uncertainty for markets.

Featured Clips

Knapp: Economy ‘Very Weak’ Right Now, We Could See 100BP in Cuts This Year

MORNING TRADE LIVE

► Play video