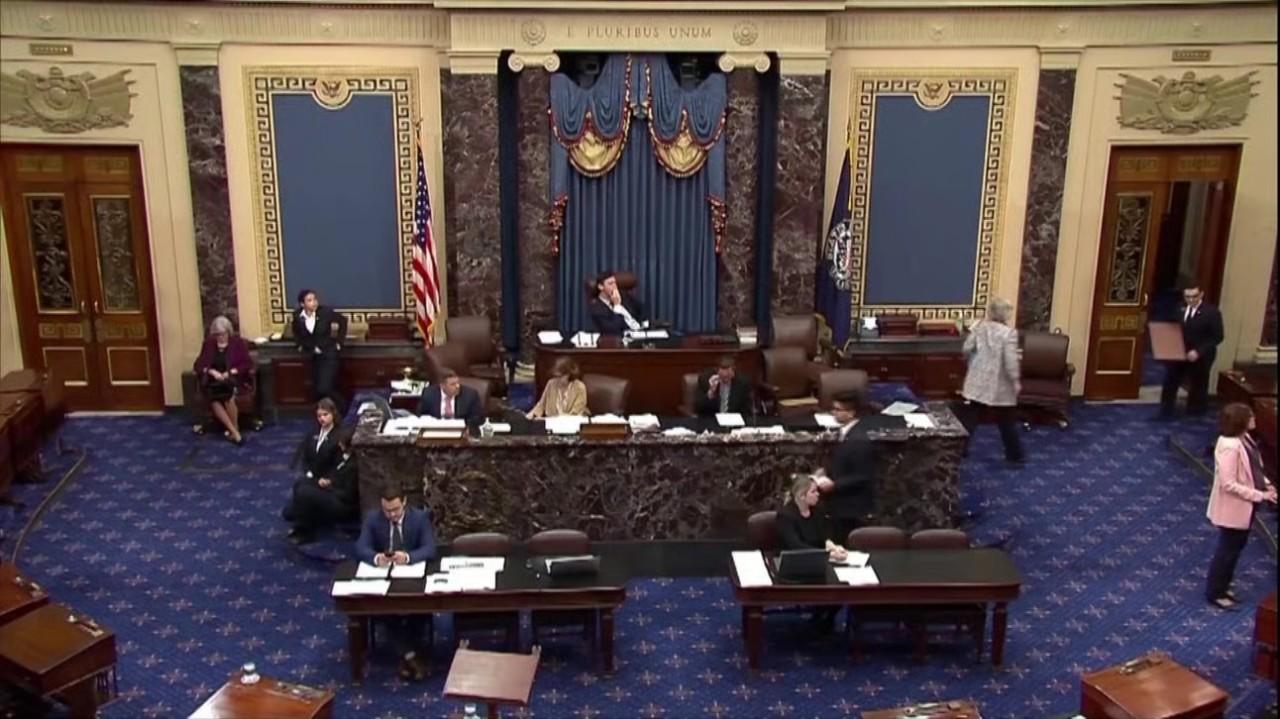

Countdown to U.S. Government Shutdown

Thomas White

Co-HostU.S. stock futures are higher in premarket trading after snapping 3-week win streaks last week. Despite the modest losses for equities last week, the major indices are still just below record highs.

Investor focus will be on jobs data this week with multiple reports due including JOLTS, ADP, Jobless Claims and ending Friday with the September non-farm payrolls numbers.

Traders will also be following a potential for a Government shutdown with a deadline of midnight on Tuesday. The Trump administration last week told federal agencies to begin preparing for mass firings if Congress does not agree to a deal to avert a shutdown.

Snapshot (as of 7 AM ET)

- Oil (/CL) – Oil prices are down 2% near $64.40 a barrel after Iraq’s Kurdistan region resumed crude oil exports via Turkey over the weekend and as OPEC+ plans another oil output hike in November, adding to global supplies.

- Gold (/GC) – Gold Futures are up about 1% near $3845, another all-time high as U.S. inflation data came in line with expectations, reinforcing bets that the Federal Reserve may continue with interest rate cuts later this year.

- Bitcoin (/BTC) – The Crypto Future is up over 2.5% near 112,700 in premarket trading.

- VIX – The CBOE Volatility Index was down 8.7% on Friday and settled at 15.29 as stocks rose.

- U.S. Dollar (/DX) – The dollar is down 0.15% to 98.02.

Biggest Premarket Movers (Mark % Change as of 7 AM ET)

- Kellanova (K): +4.82%

- Western Digital Corp (WDC): +4.51%

- Lam Research Corp (LRCX): +3.34%

- Intel Corp (INTC): -1.55%

- Wells Fargo & Co (WFC): -0.48%

- Apple Inc (AAPL): -0.22%

Economic Data

- 7:30AM ET: Fed’s Waller Speaks

- 8:00AM ET: Fed’s Hammack Speaks

- 10:00AM ET: Pending Home Sales

- 10:30AM ET: Dallas Fed Mfg. Survey

- 1:30PM ET: Fed’s Williams/Musalem Speaks

Notable Earnings

- Premarket: CCL

- Postmarket: IDT, JEF, PRGS, MTN

- Premarket Tuesday: LW, PAYX, UNFI

- Postmarket Tuesday: NKE

Upgrades/Downgrades

- Deutsche Bank upgraded Lam Research (LRCX) to Buy from Hold

- Seaport Research upgrades General Dynamics (GD) to Buy from Neutral

- Morgan Stanley upgrades Citizens Financial (CFG) to Overweight from Equal Weight

- Morgan Stanley downgraded Wells Fargo (WFC) to Equal Weight from Overweight

- Morgan Stanley downgraded Novo Nordisk (NVO) to Underweight from Equal Weight

- Freedom Capital downgraded Electronic Arts (EA) to Hold from Buy

Charles Schwab and all third parties mentioned are separate and unaffiliated, and are not responsible for one another's policies, services or opinions.