Closing Bell: S&P 500 Hits 6,900 With A.I. Still Fueling Gains—and It's Only Tuesday

Kevin Green

Sr. Markets CorrespondentKey points

- Markets closed higher, with gains in the S&P 500 (+0.23%), Nasdaq-100 (+0.74%), and Russell 2000 down (-0.55%), led by strength in tech, consumer discretionary, and materials sectors amid easing U.S.-China trade tensions and AI-driven optimism.

- NVIDIA surged to record highs, projecting $500B in revenue from Blackwell and Reuben chips by 2026, investing $1B in Nokia’s data centers, and announcing new AI partnerships with Palantir, Uber, and Oracle.

- Microsoft and PayPal rallied on OpenAI news—Microsoft’s restructured stake pushed its market cap above $4T, while PayPal gained on ChatGPT checkout integration.

Markets ended the day higher, with the S&P 500 (SPX) up +0.23%, the Nasdaq-100 (NDX) advancing +0.74%, and small caps, represented by the Russell 2000 (RUT), lower by -0.55%. The Information Technology, Consumer Discretionary, and Materials sectors led the gains, while Real Estate and Utilities dropped by more than 1%. The market continues to fuel the broader equity rally on the back of A.I. news and trade tensions easing between the U.S. and China.

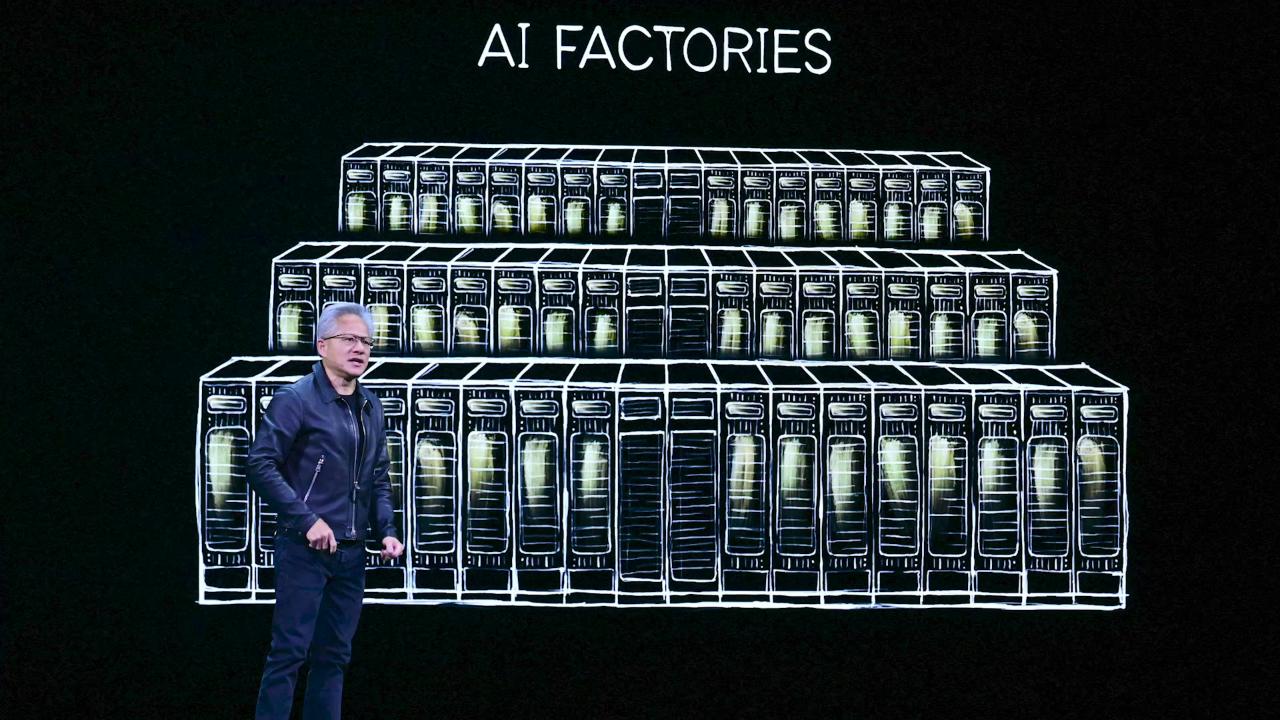

Nvidia Ramps Blackwell Production

Nvidia (NVDA) surged to record highs following major announcements at its GTC conference, including $500 billion in projected revenue from Blackwell and Reuben chips by 2026 and a $1 billion investment in Nokia’s (NOK) data centers. New partnerships with Palantir, Uber, and Oracle aim to advance autonomous fleets, build AI stacks, and develop a supercomputer for the U.S. Department of Energy.

Microsoft Pops After OpenAI Restructuring

Microsoft (MSFT) hit a new record high after restructuring its deal with OpenAI, acquiring a 27% stake now valued at $130 billion as OpenAI transitions into a public benefit corporation. The announcement pushed Microsoft’s market cap back above $4 trillion, continuing its strong year-over-year rally.

PayPal Gets a Lift from OpenAI Partnership

PayPal (PYPL) shares jumped to three-month highs after announcing a partnership with OpenAI that will let customers check out using ChatGPT, alongside a strong earnings beat and raising full-year EPS guidance to $5.35–$5.39. The stock later pulled back during the session, but the AI-driven boost and financial outlook signal renewed momentum for the fintech firm.

Key Market Events for Tomorrow

- 7:00 AM ET: MBA Mortgage Applications

- 10:30 AM ET: EIA Crude Oil Inventories

- 2:00 PM ET: FOMC Statement

- 2:30 PM ET: FOMC Press Conference

Notable Earnings for Tomorrow

- Premarket: BA, EAT, CAT, CVS, ETSY, GEHC, KHC, VZ

- Postmarket: GOOGL, CVNA, CMG, EBAY, KLAC, META, MSFT, NOW, SBUX

Featured Clips